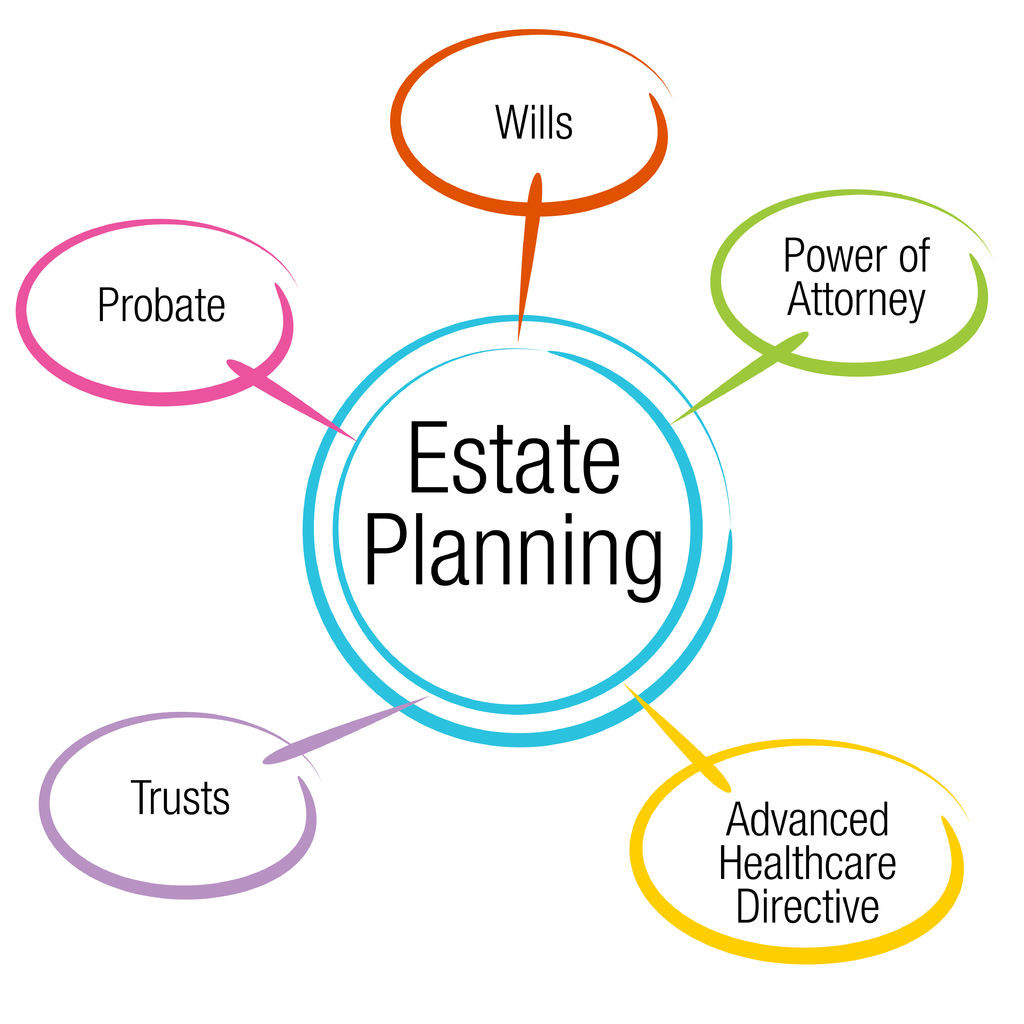

Estate planning basics in Rogers County informs people about Wills, Trusts and asset protection. Estate planning isn’t only for the wealthy. If you fail to have a plan in place, it is your family that pays the price after you pass away. Settling your affairs without a plan will likely have long-lasting and costly impacts on your family. However, if you plan ahead you will get to choose who gets your property. A plan will also reduce family squabbling and ugly legal battles. Among other things, you will also have the opportunity to nominate a guardian for your children. The first step is in understanding Estate Planning basics by calling the Claremore attorneys at Kania Law Office

Creating A Will in Rogers County

A Will is a written instrument legally executed by which a person makes disposition of his or her estate to take effect after death. If it is your Will, you are the executor. In the Will, you identify the individuals in your family that get your property and set forth exactly what they get.

If you have no assets that have legal titles your property can simply flow to the people you designate, as long as there are no objections from other family members. In the event your assets include a house, car or bank accounts, that are titled in your name, your family is likely going to be required to file a probate proceeding in district court. The court will then authorize any transfers of your property according to the terms of your Will. Many people want to know how to avoid the probate court. In most circumstances you can avoid probate by having a Trust.

Trust Basics in Rogers County

A Trust is also a written instrument legally executed which in effect becomes an individual legal entity. A Trust takes effect upon its execution. If it is your Trust, you are the settler and trustee during your lifetime. As the Settler you will fund the trust. This means that during your life you will transfer all your property into the name of the Trust. The Trust instrument also appoints successor trustees. The successor trustees take over upon you becoming incapacitated or upon your death. Then upon your death, the terms of the Trust will guide the successor trustee’s actions. The successor trustee will transfer the trust property to the beneficiaries as defined by the Trust. There is no requirement to file a probate proceeding in district court. The Trust is executed on its terms.

Durable Power of Attorney

A durable power of attorney is basically a legal instrument authorizing one to act as the attorney or agent of the grantor. A durable power of attorney can take effect upon execution or when the grantor becomes incapacitated. Once an individual is appointed as power of attorney they look to the document which identifies that individual’s authority. A person will likely grant someone power of attorney to have the authority to act in their place when they do become

incapacitated, usually to make healthcare and financial decisions. A durable power of attorney remains in effect until the grantor’s death or it is revoked by the grantor.

Estate Planning Attorney Near You.

Understanding Estate Planning basics helps you understand how to distribute your assets when you pass.The purpose of this article is to give you a cursory understanding of some of the documents used in estate planning. We hope this gets you thinking of your own planning. It is important for everyone to have a plan in place that meets your requirements. So, take the first step and contact the our Claremore estate planning attorneys at the Kania Law Office at (918) 379-4872.